Table of Contents

ToggleWavelight Plus InnovEyes is generally not covered by insurance as it is considered an elective and cosmetic procedure.

If you’ve been exploring advanced laser eye treatment options, you’ve likely come across Wavelight Plus InnovEyes. Touted as a revolutionary step in personalised laser vision correction, this procedure has garnered significant attention for its ability to customise treatment plans to an unprecedented level of precision. However, alongside its innovative capabilities, a common question arises — “Is Wavelight Plus InnovEyes covered by insurance?”

The answer, unfortunately, is no. Nonetheless, understanding why this is the case and weighing the pros and cons of this advanced technology will help you better decide if this investment is worth it for you or your patients.

Understanding Wavelight Plus InnovEyes

Wavelight Plus InnovEyes represents a leap forward in laser vision correction procedures. Using sophisticated diagnostic and laser technologies, it offers a fully customisable vision correction experience tailored to the individual’s unique eye characteristics.

Imagine the difference between buying an off-the-shelf suit versus having one tailored exactly to your measurements. Wavelight Plus InnovEyes works in a similar way—it delivers optimised results by addressing not only a patient’s prescription but also the unique construction and aberrations of their eyes, resulting in “Eagle’s eye” vision that often surpasses the standard of 20/20.

How It Works

- Comprehensive Eye Analysis

The process begins with advanced diagnostic mapping of the eye using the InnovEyes Sightmap. This tool integrates multiple cutting-edge technologies—such as 3D corneal tomography, wavefront analysis, and ray tracing—into a single device. This allows ophthalmologists to create a digital “eyevatar”, which is a 3D model mapping the individual’s eye in extreme detail.

- Custom Laser Planning

Employing artificial intelligence, the system performs virtual surgeries on the eyevatar to optimise laser corrections before any actual treatment takes place. The precision achieved in the planning stage ensures maximum effectiveness and safety.

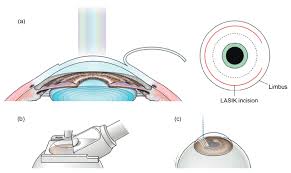

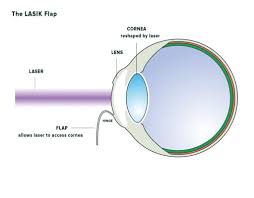

- Flap-Based Procedure

The physical correction then happens in a flap-based treatment where a thin flap of corneal tissue is created to reshape the cornea underneath according to the customised ablation pattern. Despite the technology’s many advancements, the flap-based nature of this procedure is a step back compared to flap-free options like SMILE Pro (Small Incision Lenticule Extraction), which are increasingly considered more advanced and less invasive.

The Unique Selling Points

- Highly Personalised

Unlike traditional vision correction surgery, which primarily focuses on correcting refractive errors based on glasses prescriptions, Wavelight Plus InnovEyes treats the entire structure of the eye. This approach takes into account not only the prescription but also internal and external optical aberrations.

- Precision and Accuracy

The system uses 500 targeted beams of light to create a treatment plan with microscopic precision, measuring elements of the eye to the scale of 1/100,000 of a millimetre. This leads to sharper and more accurate visual outcomes than standard treatments.

- Beyond 20/20 Vision

Patients often achieve vision greater than the standard 6/6 or 20/20 clarity, with some reportedly seeing at levels as precise as 6/5 or 6/4. This level of correction is often referred to as “HD vision.”

- Accountability for Eye Movements

The technology also accommodates involuntary eye movements during the procedure, ensuring consistently accurate results.

However, as advanced as Wavelight Plus InnovEyes is, its reliance on flap-based correction means it doesn’t surpass some newer technologies like SMILE Pro, which come with lower risks of complications such as flap dislocation or dry eye.

Why Isn’t Wavelight Plus InnovEyes Covered by Insurance?

The primary reason Wavelight Plus InnovEyes is not covered by insurance lies in its classification as an elective procedure. Insurance providers typically differentiate between medically necessary treatments (e.g., cataract surgery) and elective or cosmetic procedures that do not address critical health issues but instead enhance the quality of life. The latter category, which includes laser vision correction, often does not receive coverage.

Here are the main reasons why insurers do not cover this procedure:

1. Elective Procedure Status

Wavelight Plus InnovEyes is aimed at improving vision clarity and liberating individuals from glasses or contact lenses, but these conditions are generally not considered medically disabling. Insurance policies focus on treatments that address immediate medical risks or conditions, not optional improvements to one’s quality of life.

2. Cosmetic Nature

While incredibly advanced, the procedure is largely considered cosmetic. This puts it in the same category as treatments like LASIK.

3. High Cost

Procedures like Wavelight Plus InnovEyes can cost between ₹1,20,000 – ₹1,50,000 for both eyes. Insurers would be burdened with significant costs for what is considered a non-essential treatment, and therefore they choose not to allocate coverage.

4. Availability of Alternatives

Many insurers argue that glasses and contact lenses provide a more cost-effective solution for refractive vision correction. Since these devices are typically affordable, insurance companies often prefer to provide limited coverage for such alternatives rather than invest in expensive surgical procedures.

Considering the Investment

While the out-of-pocket nature of the procedure may deter some, there are unique benefits that warrant careful consideration. Wavelight Plus InnovEyes offers results that go beyond basic correction, potentially delivering a lifetime of high-definition vision. For those who value their independence from glasses and contact lenses, the investment may feel entirely justified.

Furthermore, some providers and clinics offer financing options or payment plans to help make the procedure more accessible to individuals concerned about the upfront costs.

Alternatives and Comparisons

It’s worth noting that other forms of laser vision correction, such as LASIK or SMILE Pro, may also not be covered by insurance for the same reasons. However, comparing these procedures highlights where Wavelight Plus InnovEyes excels and where it may fall short:

- Wavelight Plus InnovEyes delivers unparalleled personalisation thanks to AI-guided models and advanced diagnostic tools.

- SMILE Pro is also AI-based and is flap-free and minimally invasive, often resulting in shorter healing times and fewer risks of complications.

- Traditional LASIK remains a popular option for its lower costs and proven track record but lacks the cutting-edge personalisation of Wavelight Plus InnovEyes.

Choosing between these options ultimately depends on your personal priorities and budget.

Final Thoughts

Although Wavelight Plus InnovEyes is not covered by insurance, its innovative approach to vision correction and unmatched customisation make it a potentially worthwhile investment for those seeking the highest level of accuracy and clarity in their vision. However, prospective patients must weigh the costs against its benefits, particularly considering that it remains a flap-based procedure—a factor that might make alternatives like SMILE Pro more appealing for some.

If you’re considering this treatment, speak with your ophthalmologist to discuss your options, evaluate financing possibilities, and determine whether Wavelight Plus InnovEyes aligns with your needs and goals for vision improvement. Achieving the “Eagle’s eye” vision might not come cheap, but for those who prioritise cutting-edge innovation and tailored precision, the results are undoubtedly priceless.