Table of Contents

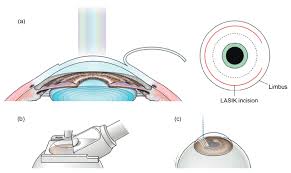

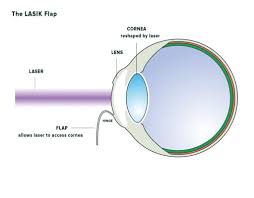

ToggleIn the modern era, where technology seeps into every facet of our lives, medical science has not been left untouched. A quintessential example is the LASIK surgery, an acronym for Laser-Assisted In Situ Keratomileusis. This intricate procedure uses laser beams to correct vision issues stemming from refractive errors – a solution for those who crave freedom from the tether of glasses or contact lenses.

But the question that often looms large is – does health insurance cover the cost of LASIK surgery?

This article dives deep into the nuances of LASIK coverage, guiding health-conscious individuals, insurance policyholders, and eye care enthusiasts through the maze of insurance policies.

Understanding LASIK Surgery

To fully grasp the coverage nuances, one must first understand what LASIK entails. It’s a surgery designed to correct vision problems such as myopia (near-sightedness), hyperopia (far-sightedness), and astigmatism by reshaping the cornea. Successful surgery can significantly reduce or eliminate the need for glasses or contact lenses.

The initial stage involves careful patient evaluation to determine eligibility for the surgery, a hurdle that can mean significant savings or a dependency on a mediclaim policy due to the high cost of the procedure.

In India, the price of LASIK surgery averages above ₹60,000 and can soar to ₹1,20,000, varying with the precision required and city rates.

Does Health Insurance Cover LASIK Treatment?

The consensus among many health insurance providers has been to view LASIK as cosmetic rather than medically necessary, thus often excluding it from coverage.

However, the Insurance Regulatory and Development Authority (IRDAI) has carved out exceptions, particularly for patients whose refractive error is equal to or more than 7.5 dioptres. Coverage under these circumstances has broadened the horizon for many, albeit under specific conditions.

Conditions for LASIK Eye Surgery Coverage under Mediclaim Policy:

- When surgery is essential due to a refractive error resulting from an injury or accident.

- When surgery is necessary for a refractive error stemming from a previous surgical procedure.

- When surgery is needed for a refractive error of 7.5 dioptres or higher.

- When surgery is crucial as the individual cannot wear glasses due to a physical deformity or persistent discomfort.

- When surgery is imperative as the individual cannot use contact lenses due to physical constraints or an aversion to them.

What Health Insurance Plans Cover LASIK?

Care Health Insurance stands out with its specialized mediclaim policies, such as Care Super Mediclaim, that cover refractive error treatments, including LASIK, for eye-sight correction where the patient’s sight is compromised beyond -7.5 dioptres. This specific inclusion grants financial reprieve to those burdened by the high cost of vision correction surgeries.

Other insurers like Aditya Birla Activ Health, Bajaj Allianz Health Infinity, Kotak Mahindra Health Care, and SBI Arogya Premier Plan also offer coverage under similar conditions, making it imperative for policyholders to scrutinize the terms and conditions of their policies.

Factors Affecting Insurance Coverage for LASIK

Several factors influence whether your LASIK surgery gets covered:

- Type of Insurance Policy: Coverage significantly varies depending on the specific insurance plan you possess. Carefully examine your policy document to understand the inclusions and exclusions.

- Medical Necessity: Some policies cover LASIK only if deemed medically necessary. This implies that your vision issues cannot be adequately addressed through conventional methods like glasses or contact lenses. Coverage may also extend to individuals who cannot wear corrective eyewear due to physical limitations.

- Age Restrictions: Certain insurance policies might impose age limitations on LASIK coverage. For instance, the policy might only cover individuals between 18 and 40 years of age.

- Refractive Error: Most insurance providers cover LASIK surgery when the patient’s refractive error surpasses 7.5 dioptres.

- Cause of Refractive Error: Coverage might also be offered if the refractive error stems from a serious injury, accident, or another surgical procedure.

The Claim Process for LASIK Surgery Insurance

Understanding the claim process is crucial for policyholders. It generally bifurcates into a:

- Cashless Claim Process: This method involves selecting a hospital or clinic within your insurer’s network that offers LASIK surgery. The healthcare provider will directly contact your insurance company for pre-authorization, and upon approval, the insurer will settle the bill directly.

- Reimbursement Claim Process: In this scenario, you choose any hospital or clinic for LASIK surgery. Following the procedure, collect the necessary documents (medical bills, discharge summaries, diagnostic reports) and submit them to your insurance provider for the claim processing.

The choice of hospital, necessary documentation, and policy specifics play a significant role in both scenarios.

Coverage Inclusions and Exclusions

Insurance for LASIK predominantly covers:

-

- Hospital-related expenses: This includes charges for the ICU, medical supplies, nursing care, etc.

- Pre and post-operative hospitalization: Coverage often extends to initial consultations, follow-up appointments, and related hospitalization expenses.

- Surgeon’s fees: This includes consultation and surgical charges.

- Anesthesia fee

- Diagnostic tests: Pre-operative and post-operative diagnostic tests and evaluations are usually covered.

However, it does not include costs for :

- Post-surgical medications and eye drops: While some plans might cover initial post-surgery medications, long-term eye drops and other medications often fall under exclusions.

- Routine eye checkups: Regular eye examinations post-surgery are generally not covered by insurance.

- Visual aids or protective glasses: Any prescribed glasses or protective eyewear post-surgery are not typically covered.

Thus, while insurance eases the financial load, patients might still need to budget for out-of-pocket expenses.

Additional Points to Consider:

Pre-operative consultations: Not all insurance plans cover pre-operative consultations to determine LASIK eligibility.

Co-payments and deductibles: Your policy might have co-payments (the fixed amount you pay) or deductibles (the amount you pay before insurance kicks in) that apply to LASIK surgery.

Recommendations:

Meticulously examine your policy document: Carefully read your insurance policy to comprehend the specific inclusions and exclusions related to LASIK surgery.

Contact your insurance provider: Don’t hesitate to directly contact your insurance company for clarification on coverage details and claim procedures for LASIK surgery.

Summing Up

Navigating through the intricacies of insurance coverage for LASIK surgery requires a keen understanding of your policy terms, the medical necessity of the procedure, and the insurance claim process. Care Health Insurance and several other providers have opened avenues for those in dire need of corrective surgery, transforming the landscape of LASIK surgery financing.

For those considering LASIK, it’s advisable to engage in thorough conversations with your insurance provider, armed with the knowledge of what conditions make your surgery eligible for coverage. This proactive approach ensures that when you decide to go under the laser, you’re not just envisioning a life independent of corrective lenses but also a financially shielded procedure.