Table of Contents

ToggleIntroduction

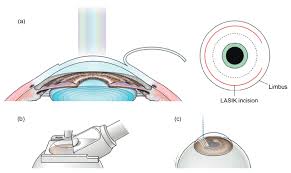

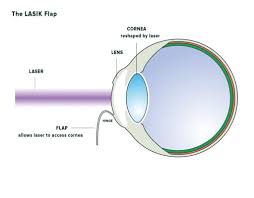

Popular elective eye surgery called LASIK (Laser-Assisted in Situ Keratomileusis) is used to treat nearsightedness, farsightedness, and astigmatism. Millions of individuals worldwide have benefitted from this incredibly efficient surgery. However, potential LASIK candidates frequently inquire about the surgery’s insurance coverage. The various aspects of LASIK insurance coverage offer tips for navigating this part of the surgery. So, Is Lasik Covered by Insurance?

LASIK (Laser-Assisted in Situ Keratomileusis) insurance coverage varies based on the insurance company and the particular policy you have as of my most recent update in September 2021. LASIK is typically not covered by health insurance coverage since it is viewed as an optional or cosmetic operation rather than a medical necessity.

To learn more about the specifics of your insurance coverage, you must speak with your insurance company directly. Remember that insurance plans and coverage are subject to change, so it is advisable to confirm the most recent details with your insurance provider or eye doctor.

Understanding Insurance Coverage for LASIK

LASIK is sometimes regarded as a cosmetic or elective operation rather than a necessary medical procedure. Because of this, the majority of health insurance policies do not pay for LASIK surgery. Insurance companies often concentrate on covering procedures that are thought to be necessary for maintaining or preserving your health. However, there are specific circumstances in which insurance may provide LASIK benefits or partial coverage.

Vision insurance provided by the employer:

A few employers include vision insurance in the list of perks they provide to employees. These vision insurance plans may, in some circumstances, offer LASIK with restricted coverage or discounted costs from participating providers. It’s crucial to thoroughly study your vision insurance policy or speak with the insurance administrator at your place of employment to find out if LASIK is eligible for any coverage or savings.

Health Savings Account (HSA) or Flexible Spending Account (FSA):

You might be able to utilize these tax-advantaged accounts to pay all or part of the costs of LASIK if your company provides an FSA or HSA. Pre-tax deductions from your paycheck are often used to make contributions to FSAs and HSAs, and the money can be utilized for qualified medical expenses, which include perhaps LASIK. However, it’s crucial to ensure that LASIK is an acceptable expense with your FSA or HSA provider and to be aware of any restrictions or criteria.

Insurance Riders or Add-Ons:

In some circumstances, particular insurance plans may offer supplemental coverage for LASIK and other vision correction operations as optional riders or add-ons. These add-on rates and varying levels of coverage are possibilities for these riders. Ask your insurance company about the availability of such riders and their fees if you’re interested in LASIK coverage.

LASIK is typically seen as elective, however, there are several situations where it may be declared medically required, such as complications from prior surgeries or medical necessity. For instance, if a patient needs LASIK to treat visual problems caused by complications from a prior eye surgery or injury, the operation may be deemed medically essential and so covered by insurance. In such circumstances, the insurance provider would call for suitable documentation proving the medical necessity from a licensed ophthalmologist.

Conclusion

Due to its elective nature, LASIK is often not covered by traditional health insurance plans. The employer-provided vision insurance, FSAs, HSAs, or specialized insurance riders may offer coverage in some circumstances. Additionally, if the required paperwork is present, situations requiring medical necessity may justify coverage.

It’s crucial to properly investigate your insurance coverage choices and speak with both your insurance provider and a qualified eye care specialist before thinking about LASIK treatment. Knowing the costs involved will enable you to make an informed choice and, if necessary, look into alternate payment methods. Before having LASIK surgery, keep in mind that insurance policies might change and that you must be aware of any modifications to your coverage.

Employer-Provided Vision Insurance:

Some employers provide vision insurance plans that may give savings from participating providers or only partial coverage for LASIK. To find out if any benefits are offered, it is important checking with your employer or insurance administrator.

Insurance Riders or Add-Ons:

Some insurance policies may provide supplemental coverage for LASIK and other vision correction treatments as an optional rider or add-on. These add-ons could have different coverage levels and higher rates.

Medical Necessity or Complications:

LASIK is occasionally required and may be deemed medically necessary, particularly if a person had difficulties from a prior eye operation or sustained an injury that necessitated LASIK for vision correction. In such cases, insurance coverage might be achievable with the right paperwork from a licensed eye care specialist.

It’s important to carefully evaluate your insurance coverage possibilities and speak with both your insurance provider and a qualified eye care specialist before choosing to get LASIK surgery. You can choose LASIK surgery with confidence if you are aware of the financial repercussions and investigate your choices for financing.

Additionally, keep in mind that insurance policies might vary over time; therefore, before having the LASIK treatment, it’s important to stay current with any changes in your coverage. To learn more about the specifics of your insurance coverage, you must speak with your insurance company directly. Remember that insurance plans and coverage are subject to change, so it is advisable to confirm the most recent details with your insurance provider or eye doctor. Coverage by insurance for LASIK can differ considerably based on the insurance company, the particular policy, and any local laws. What is protected under one policy might not be protected under another. Many individuals have to pay out of pocket for LASIK due to the restricted insurance coverage for the operation. To help with expense management, some eye care facilities could provide financing options.